Catalog excerpts

Safe Harbor Statement This Presentation contains certain forward-looking statements. Forward-looking statements concern future circumstances and results and other statements that are not historical facts, sometimes identified by the words "believes," "expects," "predicts," "intends," "projects," "plans," "estimates," "aims," "foresees," "anticipates," "targets," and similar expressions. The forward-looking statements contained in this Presentation, including assumptions, opinions and views of the Company or cited from third party sources, are solely opinions and forecasts reflecting current...

Open the catalog to page 2

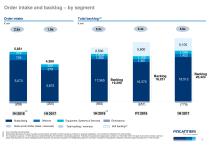

(1) Sum of backlog and soft backlog FinCAnTIERI (2) Soft backlog which represents the value of existing contract options and letters of intent as well as contracts in advanced negotiation, none of which yet reflected in the order backlog ~ i, ^ - h

Open the catalog to page 3

1H 2017 main orders Orders acquired in Q2 Norwegian Cruise Line Holland America Line (Carnival Corporation) 1 krill fishing vessel Aker BioMarine 1 live fish transportation vessel Fjordlaks Aqua 1 research expedition vessel Rosellinis Four-10 2020 (wholly-owned by the industrialist Kjell Inge Røkke)

Open the catalog to page 4

Cruise ship “Viking Sky” Cruise ship “Majestic Princess” Cruise ship “Silver Muse” FREMM “Rizzo” Submarine “Romeo Romei” OSCV “Skandi Buzios” OSCV “Far Superior” OSCV “Skandi Vinland” Client Viking Ocean Cruises Princess Cruises (Carnival Corporation) Silversea Cruises Italian Navy Italian Navy Techdof Farstad DOF Deliveries in Q2 Delivery Ancona Monfalcone Sestri Ponente Muggiano Muggiano Vard Soviknes Vard Vung Tau Vard Langsten

Open the catalog to page 5

(1) Sum of backlog and soft backlog (2) Soft backlog represents the value of existing contract options and letters of intent as well as contracts in advanced negotiation, none of which yet reflected in the order backlog (3) For comparison purposes, 1H 2016 figures are restated following the redefinition of operating segments. Following the operational reorganization carried out in November 2016, the repair & conversion services, cabins & public areas business, as well as integrated systems business, all previously included in the Shipbuilding segment, have been relocated to the Equipment,...

Open the catalog to page 6

Backlog deployment – by segment and end market Shipbuilding # ship # ship deliveries • 8 units delivered in 1H 2017, 11 units acquired in the period, 102 ships in backlog at June 30, 2017 − Deliveries up to 2025, stretching to 2027 in case of confirmation of the option for 2 ships for Norwegian Cruise Line • Naval: 36 vessels − Deliveries up to 2026, with 12 units scheduled after 2021 • Offshore(3): 44 vessels − 6 expedition cruise vessels in backlog • Additional 5 units scheduled after 2021 • 22 vessels in backlog (1) (2) (3) • Additional 12 units scheduled after 2021 Articulated Tug Barge...

Open the catalog to page 7

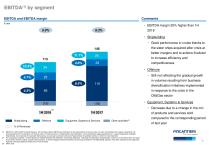

Breakdown by segment and end market^ Shipbuilding - Growth of revenues in cruise, reaching 51% of Group’s total (3 units delivered and 11 units under construction vs. 4 units delivered and 9 units under construction in 1H 2016) Offshore - Reduction of production volumes due to the downturn in production activities in European shipyards of VARD, pending the contribution of the diversification strategy - Shut down of Niteroi yard in Brazil - Positive effect of NOK/EUR exchange rate (€ 11 mln) Equipment, Systems and Services - The decline in revenues is mainly due to a lower contribution from...

Open the catalog to page 8

EBITDA and EBITDA margin € mln Shipbuilding Offshore Equipment, Systems & Services Other activities3 Comments • EBITDA margin 20% higher than 1H 2016 • Shipbuilding - Good performance in cruise thanks to the sister ships acquired after crisis at better margins and to actions finalized to increase efficiency and competitiveness • Offshore - Still not reflecting the gradual growth in volumes resulting from business diversification initiatives implemented in response to the crisis in the Oil&Gas sector • Equipment, Systems & Services - Decrease due to a change in the mix of products...

Open the catalog to page 9

Net result before extraordinary and non recurring items^ € mln • The result before extraordinary and non recurring items reflects Attributable to owners of the parent Attributable to non-controlling interests (1) Excluding extraordinary and non recurring items net of tax effect - Improvement of operating performance and margin - Increase finance expenses at € 39 mln (vs € 32 mln in 1H 2016), due to the reduction of unrealized foreign exchange gains for € 15 mln related to a Vard Promar loan in Brazil (vs. income of € 19 mln in 1H 2016) • Extraordinary and non recurring items gross of tax...

Open the catalog to page 10

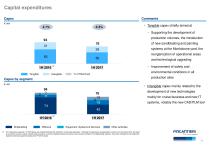

Comments • Tangible capex chiefly aimed at - Supporting the development of production volumes, the introduction of new sandblasting and painting systems at the Monfalcone yard, the reorganization of operational areas and technological upgrading - Improvement of safety and environmental conditions in all production sites • Intangible capex mainly related to the development of new technologies mainly for cruise business and new IT systems, notably the new CAD/PLM tool Shipbuilding Offshore Equipment, Systems & Services Other activities <1) For comparison purposes, 1H 2016 figures are...

Open the catalog to page 11

Breakdown by main components Comments € mln FY 2016 1H 2017 Inventories and advances to suppliers Work in progress net of advances from customers Trade receivables Other current assets and liabilities Construction loans Trade payables Provisions for risks & charges Construction loans are committed working capital financing facilities, treated as part of Net working capital, not in Net financial position, as they are not general purpose loans and can be a source of financing only in connection with ship contracts Net working capital decrease to € 206 mln, from € 265 mln in FY 2016 Increase...

Open the catalog to page 12All Fincantieri - Cantieri Navali Italiani catalogs and brochures

-

COSTA FIRENZE

2 Pages

-

SILVER MOON

2 Pages

-

ENCHANTED PRINCESS

2 Pages

-

Submarine U212A Todaro Class

2 Pages

-

SEVEN SEAS SPLENDOR

2 Pages

-

VIKING JUPITER

2 Pages

-

CARNIVAL HORIZON

2 Pages

-

CARNIVAL PANORAMA

2 Pages

-

NIEUW AMSTERDAM

2 Pages

-

SKY PRINCESS

2 Pages

-

2018 FULL YEAR RESULTS

25 Pages

-

KONINGSDAM

2 Pages

-

CARIBBEAN PRINCESS

2 Pages

-

RUBY PRINCESS

2 Pages

-

REGAL PRINCESS

2 Pages

-

MAJESTIC PRINCESS

2 Pages

-

passenger ferry

2 Pages

-

F.-A.-Gauthier

2 Pages

-

Inshore Patrol Vessels

2 Pages

-

Offshore Patrol Vessels

2 Pages

-

FINCANTIERI

50 Pages

-

ANNUAL REPORT 2016

140 Pages

-

Business Plan 2016-2020

15 Pages

-

Transverse Tunnel

6 Pages

-

M 10-16

2 Pages

-

PRESENTATIONS

14 Pages

-

Company Profile

74 Pages