Catalog excerpts

Safe Harbor Statement This Presentation contains certain forward-looking statements. Forward-looking statements concern future circumstances and results and other statements that are not historical facts, sometimes identified by the words "believes," "expects," "predicts," "intends," "projects," "plans," "estimates," "aims," "foresees," "anticipates," "targets," and similar expressions. The forward-looking statements contained in this Presentation, including assumptions, opinions and views of the Company or cited from third party sources, are solely opinions and forecasts reflecting current...

Open the catalog to page 2

Strategy overview Short and medium term financial targets

Open the catalog to page 3

BUSINESS PLAN KEY MESSAGES Long term visibility STRATEGIC GOALS All time high backlog at € 18.7 BN, of which soft backlog € 3.0 BN, and substantial commercial opportunities in advanced stage Strengthening and development of Fincantieri global leadership in the Cruise, Naval, Offshore and high value-added Equipment, Systems and Services businesses Clear strategy and defined action plan to seize opportunities and address issues: Shipbuilding Offshore Equipment, Systems and Services Synergies with Vard Significant development of commercial and industrial synergies with Vard Structural...

Open the catalog to page 4

Dynamics of cruise ships market Historical trends (2013-2015) • Starting in 2014, significant recovery of demand, with record orders in 2015 (19 units) and consequent increase of workload and shipyards production visibility - Demand recovery in “traditional markets” - Opening of new markets with great potential (e.g. China and Australia) - New players / new brands (e.g. Virgin Cruises, Costa Asia) Forecast (2016-2020) • Production capacity already filled through 2020 with ships currently in shipbuilders’ backlogs (i.e. with fleet development programs already approved by shipowners) • Steady...

Open the catalog to page 5

Revenue growth Consolidation of positive pricing trend Backlog de-risking Production/engineering synergies with Vard Capex plan Increase of workforce productivity and flexibility_ • Development of the important backlog and soft backlog as of today (over 90% of 2016-2020 revenues covered by contracts and/or MOA), driven by a strong and dedicated management team • Commercial synergies with Vard (e.g. recent Vard order from Ponant: client retention) • Demand conditions allow for consolidation of this trend • Positive impact on income statement starting from 2017 • Leverage of the engineering...

Open the catalog to page 6

Shipbuilding - Naval: market opportunities Description Fincantieri’s accessible markets Estimated defense spending for naval vessels (foreign markets accessible to Fincantieri(1)) € BN • Countries with naval shipbuilding capabilities where the Group already − Italy: Italian Navy’s fleet renewal program and other programs (e.g. FREMM) − US: LCS program • Countries with no strong local shipbuilder or with no significant naval technologies Source: IHS Jane’s – October 2015, Fincantieri analysis Spending by country (foreign markets accessible to Fincantieri) Euro in %, period 2016-2020 −...

Open the catalog to page 7

Shipbuilding - Naval: commercial strategy Timing/status Description Consolidation and development of existing programs • Italy: execution of Italian Navy’s fleet renewal program − 9 vessels in backlog (7 Multipurpose Offshore Patrol units, 1 Logistic Support Ship, 1 Multipurpose amphibious unit) − options for 3 vessels (Multipurpose Offshore Patrol units) • US: completion of current backlog of LCS program and participation to the tender for the continuation of the program − 9 vessels in backlog − 1 option • Deliveries up to 2020 • Option to be funded in 2016 • Tender from 2016 onward −...

Open the catalog to page 8

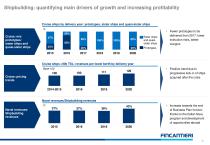

Shipbuilding: quantifying main drivers of growth and increasing profitability Cruise ships by delivery year: prototypes, sister ships and quasi-sister ships % 20% Cruise: mix prototypes/ sister ships and quasi-sister ships Sister ships and quasisister ships • Fewer prototypes to be delivered from 2017: lower execution risks, better margins Cruise ships >90k TSL: revenues per lower berth by delivery year Base 100 • Positive trend due to progressive kick-in of ships acquired after the crisis Cruise: pricing trends Naval revenues/Shipbuilding revenues % Naval revenues/ Shipbuilding revenues •...

Open the catalog to page 9

Offshore: market overview Description Offshore Oil&Gas: forecast (2016-2020) • Negative outlook for PSV and AHTS demand due to oversupply following oil price fall and significant postponements of drilling projects • Opportunities in OSCV sub-segment, notably in Middle East region • Expected recovery in demand starting Offshore wind: expected demand for SOVs(1) for O&M(2) activities of new offshore plants # of vessels • Offshore wind: expected installed capacity Sources: Pareto E&P Survey 2015, 24/08/2015, E&P CAPEX estimated based on announced expenditure budget (54 E&P companies); INTSOK,...

Open the catalog to page 10

Revenue growth Yards structure in Europe Rationalisation of production structure in Brazil Improvement of cost position and operating efficiency • Started in 2015 - 100% of Vard 2015 orders came from new clients Timing/status • Diversification into new vessel segments: - aquaculture - offshore wind - passenger (exploration cruise) and Offshore Patrol Vessel (OPV) in cooperation with Fincantieri (e.g. LOI Ponant) • Expansion of offshore business in Middle East region • Focus of Norwegian yards on core market segments and highly specialised vessels • 2016 • Focus of Aukra yard on aquaculture...

Open the catalog to page 11

Equipment, Systems and Services: strategy Timing/status Description Continuous growth of traditional businesses • Systems & Components: development of the relevant backlog (e.g. renewal of Italian Navy’s fleet) and increase of non-captive business (e.g. turbines) • Naval after-sales: expansion of service range towards full lifecycle management Consolidation of the cabins business (Marine Interiors) • Business area insourced in 2015 through an acquisition Consolidation of the integrated systems business (Fincantieri SI) • Business area started up in 2015 Insourcing of other high value added...

Open the catalog to page 12All Fincantieri - Cantieri Navali Italiani catalogs and brochures

-

COSTA FIRENZE

2 Pages

-

SILVER MOON

2 Pages

-

ENCHANTED PRINCESS

2 Pages

-

Submarine U212A Todaro Class

2 Pages

-

SEVEN SEAS SPLENDOR

2 Pages

-

VIKING JUPITER

2 Pages

-

CARNIVAL HORIZON

2 Pages

-

CARNIVAL PANORAMA

2 Pages

-

NIEUW AMSTERDAM

2 Pages

-

SKY PRINCESS

2 Pages

-

2018 FULL YEAR RESULTS

25 Pages

-

KONINGSDAM

2 Pages

-

CARIBBEAN PRINCESS

2 Pages

-

RUBY PRINCESS

2 Pages

-

REGAL PRINCESS

2 Pages

-

MAJESTIC PRINCESS

2 Pages

-

passenger ferry

2 Pages

-

F.-A.-Gauthier

2 Pages

-

Inshore Patrol Vessels

2 Pages

-

Offshore Patrol Vessels

2 Pages

-

FINCANTIERI

50 Pages

-

ANNUAL REPORT 2016

140 Pages

-

Transverse Tunnel

6 Pages

-

M 10-16

2 Pages

-

PRESENTATIONS 1.4

23 Pages

-

PRESENTATIONS

14 Pages

-

Company Profile

74 Pages