Catalog excerpts

2018 FULL YEAR RESULTS February 26, 2019

Open the catalog to page 1

Safe Harbor Statement This Presentation contains certain forward-looking statements. Forward-looking statements concern future circumstances and results and other statements that are not historical facts, sometimes identified by the words "believes," "expects," "predicts," "intends," "projects," "plans," "estimates," "aims," "foresees," "anticipates," "targets," and similar expressions. The forward-looking statements contained in this Presentation, including assumptions, opinions and views of the Company or cited from third party sources, are solely opinions and forecasts reflecting current...

Open the catalog to page 2

FY 2018 Key Messages Solid financial and operating performance • Robust order intake at €8.6 bln with orders for 27 new vessels − Order intake 14 new cruise ships for 8 different shipowners Acquisition of a new important client: TUI Cruises (RCL Group) • Record-high Total backlog(1) with 116 units at €33.8 bln (+29% vs FY 2017) − • Revenues increased by 9% to a record-high level of almost €5.5 bln (+9% vs FY 2017) • EBITDA at €414 mln (+21% vs FY 2017) and EBITDA margin at 7.6% (6.8% in FY 2017) • Adjusted Net Income at €108 mln (+19% vs FY 2017) • Net debt at €494 mln • Proposed dividend...

Open the catalog to page 3

FY 2018 Key Messages Ongoing strategic development • Building on the support of the French and Italian Governments, Fincantieri and Naval Group laid the grounds for the establishment of a 50/50 joint venture, a crucial step towards the creation of a groundbreaking industrial Alliance Defence industry Cruise industry • Fincantieri signed a share purchase agreement with the French Government for 50% of the share capital of Chantiers de l’Atlantique; upon the closing of the transaction, currently subject to the approval by the Antitrust Authorities, an additional 1% of the share capital will...

Open the catalog to page 4

VARD New organizational structure and segment review • Following the delisting of VARD, in December 2018, the full organizational integration with the Parent Company was launched, both for expedition cruise shipbuilding projects and the related shipyards, and for offshore and special vessels projects • VARD’s activities are now split between: − Cruise business unit, which includes activities related to expedition cruise shipbuilding: project management Romanian and Norwegian yards dedicated to cruise ship construction other key activities such as production oversight of public areas...

Open the catalog to page 5

Sector Vessel Shipbuilding Offshore & Specialized Vessels Cruise Ships Client Viking Cruises Silversea Cruises Norwegian Cruise Line Cunard Line Virgin Cruises Expedition Cruise Vessels Littoral Combat Ship Cable laying vessel Offshore patrol vessel TUI Cruises Ponant Hapag-Lloyd Cruises Viking Cruises US Navy Prysmian Norwegian Defence Material Agency

Open the catalog to page 6

Cruise ship “Carnival Horizon” Oceanographic vessel “Kronprins Haakon” Cruise ship “Seabourn Ovation” Carnival Cruise Line (Carnival Corporation) Institute of Marine Research Seabourn Cruise Line Monfalcone Riva Trigoso - Muggiano/ Vard Langsten Sestri Ponente Cruise ship “MSC Seaview” Cruise ship “Viking Orion” Viking Ocean Cruises Ancona Cruise ship “Nieuw Statendam” Holland America Line Marghera Expedition cruise vessel “Le Laperouse” Ponant Expedition cruise vessel “Le Champlain” Ponant Offshore & Specialized Vessels FREMM “Martinengo” Littoral Combat Ships “Sioux...

Open the catalog to page 7

Carnival Horizon Seabourn Ovation Kronprins Haakon FREMM Martinengo Module Carrier Vessel (x12) LPG Carrier Jorge Amado Viking Orion Offshore & Specialized Vessels

Open the catalog to page 8

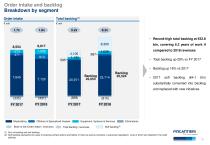

Order intake and backlog Breakdown by segment Order intake 6.2x • Record-high total backlog at €33.8 bln, covering 6.2 years of work if compared to 2018 revenues • Total backlog up 29% vs FY 2017 • Backlog up 16% vs 2017 substantially converted into backlog and replaced with new initiatives Offshore & Specialized Vessels Book-to-bill (Order intake / revenues) Equipment, Systems & Services Total backlog / revenues (1) Sum of backlog and soft backlog (2) Soft backlog represents the value of existing contract options and letters of intent as well as contracts in advanced negotiation, none of...

Open the catalog to page 9

Backlog deployment Breakdown by segment and end market Shipbuilding # ship Offshore & Specialized Vessels • 35 units delivered in FY 2018, 98 ships in backlog • Cruise: 41 vessels − Deliveries up to 2027 − 6 units scheduled after 2023, of which 4 acquired in 2018 • Naval: 28 vessels − Deliveries up to 2026 − 5 units scheduled after 2023 • Offshore & Specialized Vessels(3): 29 vessels − Deliveries up to 2024 thanks to the unit acquired in 2018 • Additional 6 units scheduled after 2023 • 1 additional unit scheduled after 2023 • Additional 5 units scheduled after 2023 For reasons connected to...

Open the catalog to page 10

Revenues Revenues breakdown by segment(1) € mln − Offshore & Specialized Vessels revenues in line with FY 2017 FY 2017 - Reported Shipbuilding Cruise Other Shipbuilding − Equipment, Systems & Services revenues up 16.7% vs FY 2017 Offshore & Specialized Vessels Naval Equipment, Systems & Services (1) Breakdown calculated on total revenues before elimina

Open the catalog to page 11

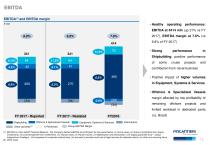

FY 2017 - Reported FY 2017 - Restated FY2018 Shipbuilding Offshore & Specialized Vessels Equipment, Systems & Services Eliminations Other activities2C O % Revenues Group EBITDA Margin • Healthy operating performance: EBITDA at €414 mln (up 21% vs FY 2017), EBITDA margin at 7.6% (vs 6.8% of FY 2017) • Strong performance in Shipbuilding: positive performance of some cruise projects and contribution from naval business • Positive impact of higher volumes in Equipment, Systems & Services • Offshore & Specialized Vessels margin affected by low profitability of remaining offshore...

Open the catalog to page 12All Fincantieri - Cantieri Navali Italiani catalogs and brochures

-

COSTA FIRENZE

2 Pages

-

SILVER MOON

2 Pages

-

ENCHANTED PRINCESS

2 Pages

-

Submarine U212A Todaro Class

2 Pages

-

SEVEN SEAS SPLENDOR

2 Pages

-

VIKING JUPITER

2 Pages

-

CARNIVAL HORIZON

2 Pages

-

CARNIVAL PANORAMA

2 Pages

-

NIEUW AMSTERDAM

2 Pages

-

SKY PRINCESS

2 Pages

-

KONINGSDAM

2 Pages

-

CARIBBEAN PRINCESS

2 Pages

-

RUBY PRINCESS

2 Pages

-

REGAL PRINCESS

2 Pages

-

MAJESTIC PRINCESS

2 Pages

-

passenger ferry

2 Pages

-

F.-A.-Gauthier

2 Pages

-

Inshore Patrol Vessels

2 Pages

-

Offshore Patrol Vessels

2 Pages

-

FINCANTIERI

50 Pages

-

ANNUAL REPORT 2016

140 Pages

-

Business Plan 2016-2020

15 Pages

-

Transverse Tunnel

6 Pages

-

M 10-16

2 Pages

-

PRESENTATIONS 1.4

23 Pages

-

PRESENTATIONS

14 Pages

-

Company Profile

74 Pages